DID YOU KNOW?

With proper planning, your family business can avoid becoming another statistic.

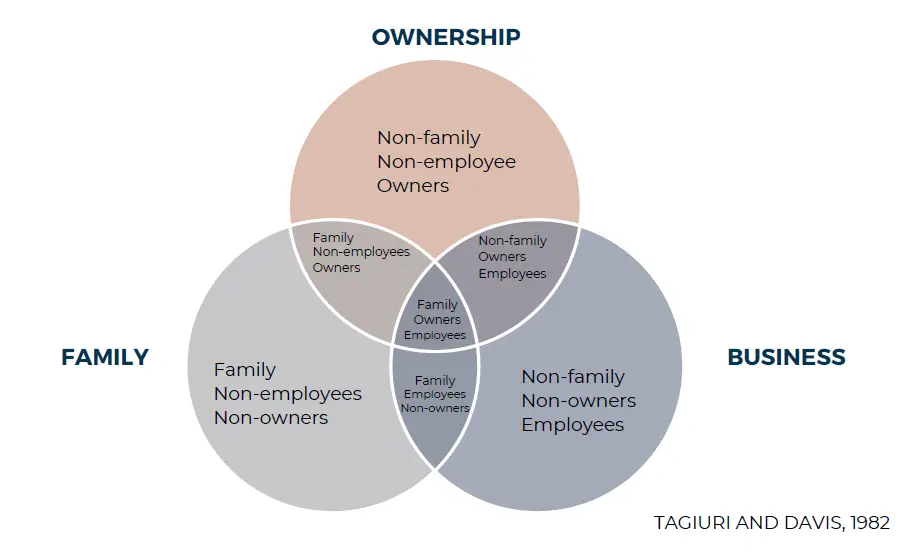

3-CIRCLE MODEL

In a non-family business, shareholders (or owners) and management must simply implement the strategy and focus on the business. Family businesses, however, have more complexities as illustrated by the 3-circle model.

Three stakeholder groups overlap in a family business: ownership (such as shareholders), family, and business. The three groups must work together to ensure that the family business thrives.

PERMUTATIONS INCLUDE:

- Some family members work for the business.

- Some family members own the business.

- Some family members are not involved in the business.

Why a family constitution?

A family grows faster than the business grows!

Conflict, uncertainty, expectations, rights, and obligations of all individuals must be defined and managed in a family business. Therefore, every family business must draft a basic agreement to survive. This is called a FAMILY CONSTITUTION.

The Building Blocks of a Family Constitution

1. The family dream

AS UNDERLYING STRUCTURE

The family dream is the cornerstone of every successful family business. This is the foundation where effective communication strategies must be initiated.

What constitutes your unique family dream?

Are all stakeholders aligned with this dream?

Is there a collective commitment to ensuring the business’s longevity over generations? Parents may have this dream, but how does the younger generation think and feel about it?

Deciding on the family dream is not only beneficial – it is essential for the sustained cohesion of your family business. All stakeholders must embrace the core values and principles that underpin this dream. Once agreed upon, this shared family dream and strategic outlook can be effectively implemented through a clearly defined vision and mission statement.

2. Financial capital

AS A PILLAR

Every successful family business requires a robust financial capital framework to ensure longevity. This framework extends beyond merely maintaining a healthy balance sheet – it encompasses several critical components that ensure financial stability across generations.

STRATEGIC DEBT MANAGEMENT

Clear debt guidelines are essential. A policy defining optimal debt levels protects against overleveraging while supporting growth.

WEALTH MANAGEMENT STRATEGY

The FAMILY CONSTITUTION should contain guidelines for drafting a wealth management strategy, which deals with the diversification of investments (across jurisdictions and asset classes). This should preferably be drafted with the guidance of a professional financial advisor.

The Galileo Advice team frequently encounters scenarios where the founding generation personally guarantees business credit facilities. Such arrangements require careful review to prevent a scenario where the credit facility must be settled when the older generation passes away. A comprehensive life coverage assessment is essential to ensure business continuity and protect against unexpected financial shortfall or disruption.

A family that farms must have a passion for planting, not for money.

Christie Truter,Truter Farming Trust

Remuneration Framework

Family discord can stem from an inadequate remuneration framework, particularly when some family members are employed by the family business, and others are not. Family members employed by the family business usually prioritise long-term growth and capital expansion, while family members not employed by the business may favour dividend distributions. The FAMILY CONSTITUTION must carefully align these different interests to foster harmonious family relationships. Holistic financial planning must also be done for each family member and the family business.

Family businesses often have to shoulder the financial burden to fund family members who are unable to retire. The FAMILY CONSTITUTION should establish mandatory financial planning protocols that enable individual independence. A robust remuneration framework (including dividend and distribution policies) should also be addressed. If the family owns joint lifestyle assets, the use and administration of these assets can also be defined in the FAMILY CONSTITUTION.

3. Human Capital

AS A PILLAR

At ZZ2, our family extends beyond the Van Zyl bloodline. We create a real home for every employee, and everything we do as a family reinforces that promise.

Tommie van Zyl, chief officer of ZZ2

At ZZ2, our family extends beyond the Van Zyl bloodline. We create a real home for every employee, and everything we do as a family reinforces that promise.

Tommie van Zyl, chief officer of ZZ2

Human capital is the assets in the family business that you can’t quantify. Business owners often agree that the business is only as strong as its employees. Every family business must ensure that it hires the best people for each position, and that the employees and management are continuously encouraged and developed. The employees are an asset to your family business.

Every stakeholder within the family business must adhere to a clearly defined framework of values and principles, formally documented within the FAMILY CONSTITUTION. Family businesses inherently possess an extraordinary wealth of intellectual capital, and the FAMILY CONSTITUTION must ensure that this intellectual capital is articulated, developed, and passed on to the next generations.

4. Legal structuring

AS THE ROOF

Legal structuring is the roof that protects the family home from various elements!

The transfer of assets and ownership over generations is dealt with by different documents in the various entities of the family business.

The FAMILY CONSTITUTION establishes a mandatory obligation for all income-generating family members to maintain valid, current wills and implement comprehensive estate planning strategies. Detailed guidelines are outlined within the FAMILY CONSTITUTION.

Succession of trust assets is regulated by the trust deed and letter of wishes, not through the will. A series of statutory documents regulates the trading of company assets. It is important for these documents of the various entities to have a common goal to ensure a smooth transition of assets and ownership.

The FAMILY CONSTITUTION describes the structures selected for business operations while establishing protocols for periodic reassessment of these entities in consultation with qualified tax, financial, and legal advisors.

The chosen ownership structure is also set out in the FAMILY CONSTITUTION and reviewed after, where necessary, professional tax, financial or legal advice has been sought. It is important to address the family’s ever-changing needs and ownership strategy.

The FAMILY CONSTITUTION also sets out the general principles of the ownership strategy and the ownership model that determines what rights or expectations future generations may have concerning the division or realisation of the family assets. The ownership strategy also contains more detailed provisions to, among other things, deal specifically with the circumstances when family assets are sold and to establish guidelines on how the capital will be used and/or divided between family members in such cases. These provisions are important when some of the businesses (or shares in those businesses) are sold. It also contains principles to safeguard family assets in the event of a divorce.

5. Succession planning

AS THE DOOR

The relationship between the older and younger generations is very important. Family businesses often fail because the older generation holds on to what they have built up, and does not want to transfer skills and control to the younger generation.

Claude Cloete, Eastern Cape farmer

Succession planning is the door to the family home. The older generation must walk through the door of transition and retirement and open the door for the younger generation to step in. No family business can continue to exist over generations without the older generation passing the torch to the younger generation. Clear succession plans have to be included in the FAMILY CONSTITUTION to

ensure that none of the intellectual capital of the family business is lost. Some of the questions addressed in the succession plans are:

- How is management transferred to the next generation?

- Who is the successor?

- Over what period does it take place?

- What training, experience and character traits should the successor(s) have?

This is not a place of giving up, surrendering, or giving away, it is about transferring on.

– Breyten Breytenbach

The Family Forum & Family Council

The family needs a governing body to ensure the implementation of family values and principles in the family business. This structure is the Family Forum, which consists of the immediate family members (and their spouses).

The latter accepts the FAMILY CONSTITUTION and functions as a body that ensures that the agreed- upon family values are applied in all the family businesses. The Family Forum also acts as the guardian who manages, protects, and preserves the businesses and business assets across generations.

Within the Family Forum, differences and conflicts between family members can be handled constructively with regular and effective communication. This means that conflict is addressed and successfully resolved.

FAMILY COUNCIL

A Family Council is the elected management committee of the Family Forum, which ensures that communication is carried out at management level on behalf of the Family Forum within the different branches of the family businesses.

Drafting a family

CONSTITUTION

The process of drafting the FAMILY CONSTITUTION is just as important as the document itself. Family businesses are like fingerprints – no two are alike. The values, rules, and principles that work for one may not apply to another.

The relationship between the individuals in the family business is much more important than the paper that regulates that relationship! There are two main goals that you want to achieve before you start the FAMILY CONSTITUTION PROCESS.

1

The family’s vision and dream must be formulated, and it must be ensured that everyone is aligned with this family dream. This requires a consultation process to understand everyone’s dreams and needs.

2

The underlying emotional tensions and conflicts must be explored and resolved to prevent them from undermining the FAMILY CONSTITUTION’S effectiveness.

REMEMBER! Drafting a FAMILY CONSTITUTION is not a quick process, and often takes a year to finalise.

Implementation is crucial. Therefore, Galileo Advice assists family businesses in facilitating the first Family Forum meeting approximately six months after the signing of the FAMILY CONSTITUTION.

George Robertson and Monique Bräsler from Galileo Advice will meet with the whole family and each family member individually. They help shape a shared family dream while understanding everyone’s expectations. With these insights, they create a straightforward FAMILY CONSTITUTION framework of 15- 25 key points which all family members must agree to. Once everyone approves, the actual drafting of the FAMILY CONSTITUTION begins.

Being a steward means that the family business is more important than the individual, and everyone accepts the responsibility to leave it in a better position than he/she received it.

The greatest gift to a family business is to create a culture of stewardship and to draw up a FAMILY CONSTITUTION for a family business.

I was the steward here for a while.

PG du Plessis, shortly before his death, referring to the family farm

Your children, grandchildren, and their descendants will be forever grateful to you for ensuring the survival of your family business through a FAMILY CONSTITUTION!

Secure your family’s legacy today!

Contact Us

GEORGE ROBERTSON

George is an executive director of Galileo Advice. He is also a practicing attorney at VanDerMerwe & Robertson attorneys. He believes that drafting a FAMILY CONSTITUTION is the cornerstone that ensures your family business endures for generations to come.

MONIQUE BRÄSLER

Monique is the head of Galileo Advice’s Wealth Management and helps families with the financial capital component of their FAMILY CONSTITUTION. She holds an honours degree in financial planning and also a diploma in investment advice from the Chartered Institute of Securities and Investments of the United Kingdom.

THEO VORSTER

Theo Vorster is an economist, co-founder and CEO of Galileo Capital, and a director of Galileo Advice. Family businesses are close to his heart, as preserving wealth for generations can be an asset to the entire family. He believes that a FAMILY CONSTITUTION can help make the family’s dream of a successful family business a reality.

Lee- Ann Naude - Paraplanner

Lee-Ann is a dedicated Financial Planner with a career spanning back to 2016. Holding a CFP designation, she am committed to the highest standards of professional conduct and ethics. Her approach is rooted in a deep passion for financial wellbeing, ensuring that every strategy we implement is not only compliant but perfectly aligned with the client’s needs.

PLEASE NOTE! No fees are charged after the first consultation and it is obligation-free. It is an opportunity for all stakeholders to decide whether they want to proceed with the process. Galileo Advice is assisted by its shareholders (Galileo Capital and VanDerMerwe & Robertson Attorneys) to provide various intergenerational services such as estate planning and structuring to various South African family businesses.